Sambla Group has teamed up with Tink to offer lenders access to more accurate affordability assessments. With the addition of three key products – Income Check, Risk Insights, and Tink’s latest tool, Expense Check, to further innovate the lending application process.

The partnership will help ensure that Sambla Group can offer a smarter, more inclusive lending process going forward, where extra consumer insights can help us get a deeper knowledge to deliver more tailored application processes. With this fresh news, we’ve put together this article that outlines everything you need to know about risk assessments and how open banking can help revolutionise them.

What is a risk assessment?

Generally speaking, a risk assessment is the process of identifying and analysing factors that could negatively impact assets – and making judgments accordingly. A common example is when lenders assess the risk profile of applicants to determine whether they should approve or deny their application for a loan. The goal, of course, is to ensure that they won’t lend money that can’t, or won’t, be paid back.

Risk assessments aren’t just necessary for lenders, of course. Landlords and rental services, car leasers and telco companies, for example, also need to evaluate applicants and the potential risk of entering an agreement with them.

How is an assessment usually done?

Since in most cases businesses are looking to understand whether a prospective customer might present a financial risk or not, they’ll make risk decisions by analysing the customer’s financial situation.

To do that, lenders can request information from external credit bureaus, or request that applicants submit financial statements for them to review – that might mean proof of income (such as payslips and tax return statements), proof of expenses or information on loan exposure through (usually lengthy) application forms.

Most lenders use financial models to estimate the probability of someone’s default after borrowing. To feed and continuously improve these models, they need a wealth of data – and the more sophisticated and granular it is, the better. That’s where things start to get tricky.

What are the challenges with the current methods?

Having a good understanding of someone’s risk profile has always been a challenge, because most data sources used in evaluations are outdated, costly and incomplete – meaning they can’t always provide the information needed to understand someone’s true risk value.

Plus, to remain relevant, today’s products and services don’t just need to be digitally available – they also need to meet high expectations for simplicity and functionality. Any application flow that requires significant effort from the user, or involves long waiting periods has a high likelihood of being abandoned.

What can a better risk assessment process help solve?

To start with, a risk assessment process that gives your business more data points to base decisions on will, quite simply, help reduce your risk exposure while still improving acceptance rates. This means more business, at lower risk.

And speaking of more business – removing friction from the application flow with a speedy and convenient process that can give quick results will also mean your applicants will be more likely to stick around and seal the deal. There’s no big discouraging roadblock to make them abandon their application and go look for a loan elsewhere.

Having a seamless user experience doesn’t just benefit consumers – it makes your business more attractive too.

So. By now you might be wondering what makes for a great risk assessment process. Here’s our take on that.

What should a solid risk assessment process look like?

Let’s say a potential customer wants to borrow money to buy a property or subscribe for data services, and you need to understand their risk profile.

Ideally, you’d have an assessment process that meets their expectations (fast, simple, fully digital) while still addressing all your business needs (having enough information to make accurate risk decisions).

In this ideal world, your risk assessment process should then be convenient, reliable and complete. Here’s what we mean by that.

Convenient

Everyone wants to get things fast, and if you can’t offer that, your would-be customers will be flocking to services that do. Having a speedy digital application process should be seen as essential.

And please note we’re talking about convenience in a ‘getting it solved with a few clicks’ way, and not a ‘submitting only 11 documents instead of 14’ way.

Additionally, customers don’t want to wait around for days to get an answer – they want to know if it will be a ‘yes’ or ‘no’ right away.

Convenience isn’t just a benefit for users, of course. By being able to speed up and streamline your operations, as well as offer quicker results, you’ll also considerably improve business efficiency.

Reliable

Reliability isn’t just a matter of ‘will it work, and can I trust it?’ When it comes to assessing a loan, the information has to be 100% verifiable and secure. Beyond that, you also need to know that you can rely on the information to be up-to-date and a true reflection of the current circumstances of the applicant.

This might sound like a given, but the fact is many businesses still have to rely on months- or even years-old data (which is often what you get from credit bureaus).

Making risk decisions based on years-old data would be akin to going to a doctor and getting a prognosis based on your past years’ blood work. Results may not be as dependable as you’d hope.

Complete

With the ever-evolving labour market (think gig economy, decreasing lengths of tenure, furlough schemes) making fixed income streams not always be the norm, and the rise in the subscription economy meaning people may have significantly less disposable income, you really need more granular information to have the full picture of someone’s financial standing.

With recent advances in data processing and risk modelling, when it comes to applicant information – the more data you can get, the better.

You should look for more than information on what the applicant’s loan exposure was six months ago. The more you can closely examine someone’s spending patterns – and how they’ve changed over time, the better you can identify markers that could indicate ‘risky behaviours’ such as gambling, or reliance on overdraft.

Is there a convenient, reliable and complete risk assessment method out there?

As mentioned, the common methods used to determine an applicant’s creditworthiness – reports from credit bureaus, documentation submitted by the applicant (or in some cases internal data from the financial institution they’re applying to) – have their shortcomings, and may not always reveal the applicant’s true risk.

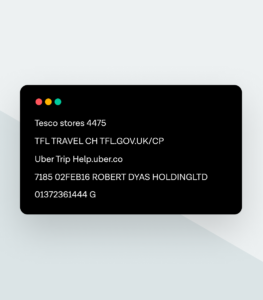

To start with, credit reports are limited to the applicant’s loan exposure. So, if they pay back their loans on time, you’ll see that reflected in the reports. However, credit reports won’t indicate what their account balance is on the first and the last day of the month (maybe they’re really struggling to get by) or whether the applicant may have made several dodgy ATM withdrawals in the past few days.

As for requesting documentation from the applicant – it doesn’t score any points for ‘convenience’ and the results won’t always be reliable either. It comes with a lot of friction for the applicant, not to mention high operational costs of gathering and processing the information. And even though everything may seem legit – financial statements can be easily falsified.

Finally, internal data can be a valuable source of information, but it will be limited to your existing customers. While the data is reliable and can be reached instantly, it might not always paint the full picture. After all, people can have multiple accounts with different providers.

So what can you do when you’d like a risk assessment method that does tick all the boxes?

Risk Insights: better way of assessing risk

By providing a way to access consumers’ bank account data, open banking is making it easier to perform more in-depth risk analyses. With fresh, real-time transaction data coming straight from the applicant’s bank, the information won’t just be reliable, it will also be reliably up-to-date.

You also won’t just get data from the past few months (say, as you might if asking for a couple of recent payslips) – the data can go back for years, and it gives a very deep understanding of the applicant’s financial capability and spending behaviours. This makes it more complete than most other methods out there.

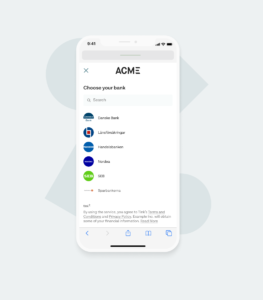

Finally, open banking makes the process convenient, as it doesn’t require any real effort from the applicant – or the lender. The applicant just needs to authenticate with their bank to authorise the use of their data (which can be done with a few clicks). And the lender doesn’t need to go through mountains of data to make sense of what’s going on – at least not if they’re using a solution that makes sense of the data for them. Like Tink’s.

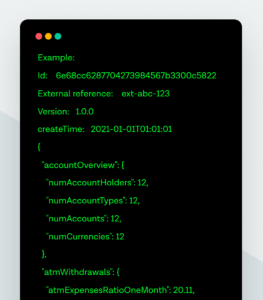

With Tink’s Risk Insights, the data digging is done automatically in the background, resulting in an in-depth risk analysis highlighting different risk factors for lenders to consider. It works like an MRI scan of someone’s finances, revealing risk patterns that might not be spotted by credit reports – such as gambling, ATM behaviour, frequency of overdraft, and more. And, importantly – it shows these risky patterns historically, so you can also know how these behaviours might have changed over time.

How it works

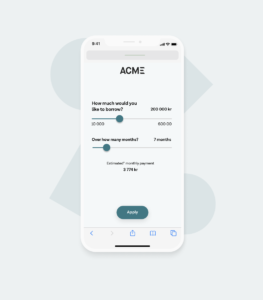

Here’s how the user’s application process might look like when doing a risk assessment with Tink:

And here’s what happens in the background:

The intelligence behind the insights

Although it may look and feel very simple from the end user’s perspective, there’s of course a lot of intelligence and complexity behind powering a product that can deliver these types of insights.

Getting the data analytics that happens in the background to the level of sophistication and reliability that Risk Insights has took extensive development and testing with real default data.

More than 35 thousand potential risk features were detected and approximately 300 features were identified as the most important markers during this testing period. And of course, the accuracy levels achieved are a result of a continuous testing and improvement process.

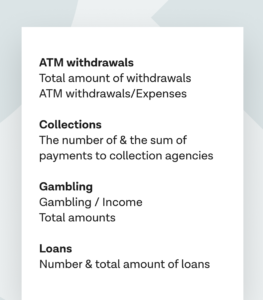

Some of the key features you’d get in a Risk Insights report include:

- Gambling: gambling is a behaviour that’s not exposed on a credit report but is certainly a red flag for lenders. Reviewing how much of the income is spent on gambling is a valuable risk feature.

- Collections: a collection agency is a company that lenders use to recover funds that are past due or from accounts that are in default. Detecting a payment made to a collection agency shows that the applicant failed to make agreed loan repayments – a definite red flag for lenders.

- Overdrafts: being overdrawn often indicates overspending and can be added to the decisioning scheme from that perspective. The number of transactions resulting in a negative balance and how many days the applicant remained overdrawn is reported in Risk Insights.

- Loans: the applicant’s loan exposure is shown in credit reports from external bureaus. However, the figures don’t always reflect the present situation as they can be 3-6 months old. With Risk Insights, you get today’s figures.

- ATM withdrawals: studies indicate that countries like Canada, Sweden, UK, France and the US are approaching a cashless future. While cash may still be still king in some places, it’s not traceable, meaning the lender can’t know for sure what the applicant is spending on. Information on cash withdrawals may be a valuable insight depending on the country (particularly in places where the behaviour might be rare). Total amount, and the share of ATM withdrawals over all expenses can be viewed with Risk Insights.

- Balance statistics: total balance at the first and last day of a period of transactions together with the maximum and minimum balances are beneficial details to have, giving insights on the variance within someone’s financial limits.

- Cash flow statistics: cash flow can help determine the total amount of outgoing and incoming transactions, as well as the ratio between them (identifying how much of the income is disposable, so to say). This is a great way to help understand if an applicant can reasonably afford to make regular payments.

- Transactions and account activity: maximum and minimum transactions (both incoming and outgoing) are reflections of the applicant’s cash flow that many lenders appreciate in their evaluations.

Who can benefit from Risk Insights?

Generally speaking, Risk Insights can be a good fit for anyone looking for a convenient, reliable and complete tool to assess whether someone will be able to repay a loan. Here’s an overview of how different segments can benefit from it.

Financial service providers

The most obvious use case for Risk Insights is using it to improve and digitalise loan application processes. Banks (retail and challenger alike), online lenders providing consumer finance and credit card providers could all benefit from the instant and fully digital nature of the user flow.

In addition to this, in many countries, an individual’s credit rating can be affected negatively each time someone applies for a loan, something that Risk Insights can reduce or remove completely.

Another advantage is the ability to lend to unscorable consumers. Many people need to start from scratch when they move to a new country and wait for months to show a credit history before they can apply for a credit card. Therefore, time to money could be shorter with Risk Insights.

Non-financial service providers

Non-financial service providers with leasing functions are other groups that can take advantage of seamless digital application processes with Risk Insights. Proptech, travel and hospitality, automotive or telco companies are some of the examples falling into this group. Loans’ ticket sizes are usually smaller in this category, but the risk can be higher for a car lease company renting out a car, for example.

Additionally, applicants would prefer a fast and digital process instead of filling in pages of application forms, then waiting for days or even weeks for an answer. They might not be thrilled to come back as a return customer if after learning a credit check was conducted for their vacation booking.

The fact of the matter is: whatever your business may be, customers want to get things done quickly and painlessly – and it’s safe to assume you want to have more (and happier) customers with fewer losses. Risk Insights can meet all these objectives and ultimately make for a better lending experience all round.

What it can help you achieve

Risk Insights is sure to bring a host of benefits to your business – just like it already has for our existing customers. Here are some of the results we’ve seen so far:

Improving accuracy in decisions:

- A Swedish lender realised a 10x model uplift compared to credit bureaus

- Another Swedish lender optimised their processes by streamlining to 4 risk models instead of 15+

Approving more customers, while minimising risk:

- A Polish lender improved loan acceptance by 60%

- A Swedish lender reduced credit losses by 25%

Increasing predictive power:

- An unsecured loan lender in CEE experienced 46% uplift

- A leading lender in Poland increased Gini by 40%

- A pioneering Swedish lender’s Gini increased by 32%

Is Risk Insights right for you?

If you’ve experienced your own struggles in making solid risk assessments, the good news is: there’s a better way. By taking advantage of open banking technology, you can remove barriers for your customers and simplify application processes for your business.

Want to learn more about the tech behind Risk Insights? Get a glimpse in our getting started guides.

Hear more from Tink at the Digital Finance Forum

Author