On Wednesday, January 22nd, we joined Samlink for a breakfast seminar on the future of payments. Over the course of 180 insightful minutes, we heard from:

- Pål Krogdahl (Director of Technology Strategy and Advisory Services, Samlink)

- Tomi Mölsä (Senior Advisor, Advisory Services, Samlink)

- Perttu Kröger (Country Manager Finland & Director of Open Banking, Vipps MobilePay)

- Kai Lindström (VP, SOK Payment Services)

- Alexander Yin (Group President, Epassi)

- Ville Sointu (Chief Strategist, Digital Currencies, Nordea)

- Janne Salminen (CEO, Fintech Farm)

The Emerging Generation: TikTok Meets Finance

Younger users, immersed in TikTok and on-demand digital services, now find physical wallets and credit cards outdated. Instead, they favor apps, BNPL, and instant experiences.

Action: Check your Gen-Z preparedness. Be ready to embrace the change.

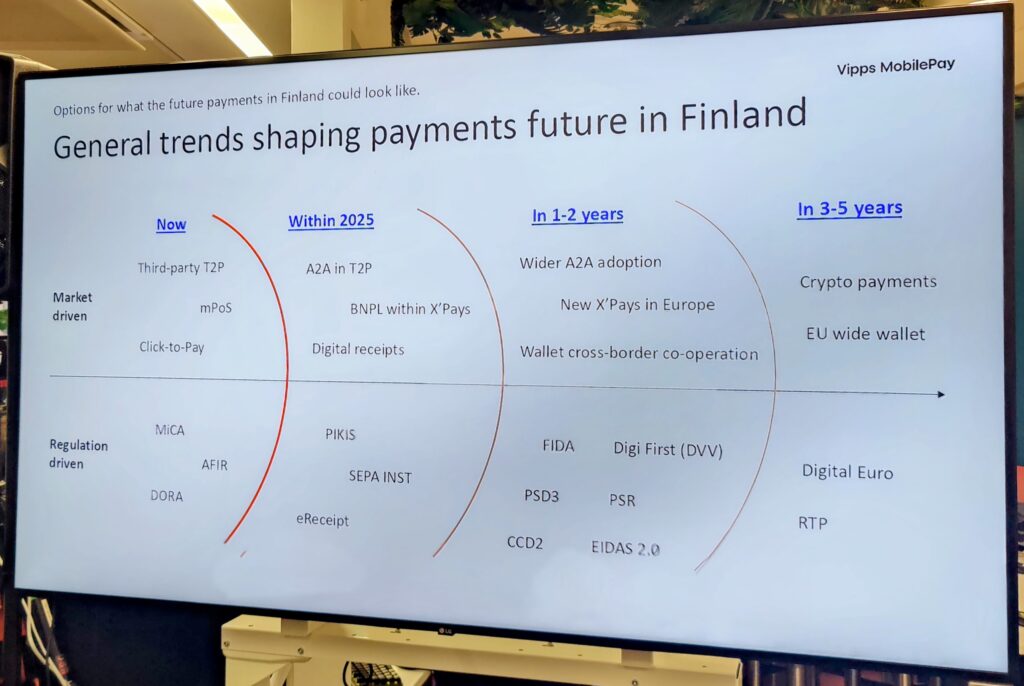

Rails & Regulation: A Shifting Foundation

Today’s payment infrastructure is evolving under regulatory pressure (PSD3, SEPA Direct, eIDAS). Central banks could become more directly involved in retail finance if the digital euro gains traction.

Action: Watch for upcoming EU regulations. Early adaptation can help you stay compliant and gain a competitive edge.

A2A, Crypto, and EU-Wide Wallets

The future of payments bridges business-led innovation (A2A, crypto) with regulatory-led initiatives (digital IDs, e-wallets). This dual focus could rapidly reshape how payments are managed across the EU.

Action: Survey your customers for their interest in emerging payment options like crypto. Align or integrate those services where they fit.

The Future of Retail: Payments in a Major Role

The pandemic accelerated trends from home deliveries to cashierless stores. For major retailers like SOK, the question remains: how long will card-based systems remain dominant, and can A2A solutions reduce costs without burdening customers?

Action: If you’re in retail or partnering with large merchants, explore alternative payments (e.g., A2A) that cut fees and friction. Be open to new checkout experiences.

Payment as Experience: Ecosystems Are Key

Technology alone isn’t enough; a compelling payment solution requires a beneficial overall experience. Epassi’s “flywheel” strategy underscores the importance of building an ecosystem where all participants benefit—driving exponential growth.

Action: Examine how your service creates mutual wins for users, merchants, and partners. Ecosystem-driven strategies can scale faster than isolated solutions.

Digital Currencies: 2029 and Beyond

A digital euro may emerge around 2029, offering consumers access to central bank liabilities akin to cash. However, costs, complexity, and uncertain user demand keep the debate alive.

Action: Start evaluating how digital currencies might integrate into your offerings. Even if widespread adoption is years away, being prepared can position you as an innovator.

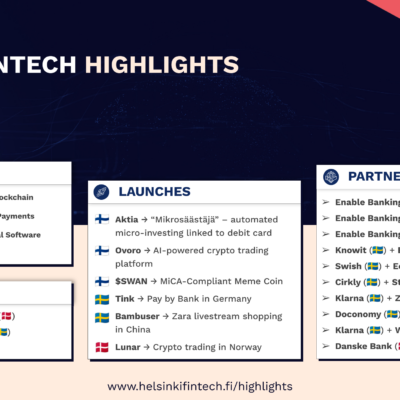

Consolidation, A2A, and B2B Niches

Of 213 Finnish fintechs, 46 focus on payments. While consolidation is a major trend—especially in consumer payments—opportunities remain in B2B.

Action: Identify unserved or underserved niches, particularly in B2B, where large platforms haven’t locked out new entrants.

A2A Developments Unfold Weekly

Account-to-account payment solutions see constant updates: new APIs, pilot programs, and integrations roll out nearly every week. Its full impact may still be a few years off.

Action: Keep tabs on partnerships, new standards, and regulations to capitalize on fresh opportunities as they emerge.

Conclusion: A Rapidly Changing Ecosystem

The discussions highlighted that payments are evolving on multiple fronts—technology, consumer habits, and regulatory forces. Staying competitive means having robust tech, adaptability, and an ecosystem-centric mindset.

Thanks to all our speakers and participants for sharing these insights. If you’d like to explore any topic in more depth we suggest joining us at the Nordic Fintech Summit!